oklahoma franchise tax due date 2021

For these corporations franchise tax is due and payable on May 1 of each year and delinquent if not paid on or before June 1. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200.

Article Review Tougher Than Irs California Franchise Tax Board Milikowsky Tax Law

The Oklahoma Tax Commission will waive penalty and interest on tax payments received between April 15 and June 15 2021 up to twenty-five thousand dollars 2500000.

. 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 259 minutes to complete The 2021 Form 512. Due date your annual franchise tax must be paid by june 1st. Any taxpayer with an oklahoma franchise tax liability due and payable on or before july 1 2021 will be granted a waiver of any penalties andor interest for returns filed by august 1.

Your Oklahoma return is due 30 days after the due date of your federal return. If a taxpayer computes the franchise tax due and determines that. If a taxpayer computes the franchise tax due and determines that.

Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and. He said the states June 15 extension applies to personal 2020 income tax returns franchise tax returns and 2021 income tax estimates. For these corporations franchise tax is due and payable on May 1 of each year and delinquent if not paid on or before June 1.

Tags Federal And State Tax. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms. See page 14 for methods of contacting the Oklahoma Tax Commission OTC.

Tax Rate other than retail or wholesale 075. Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by August. Download or print the 2021 Oklahoma Form 512 Corporate Income Tax Return form and schedules for FREE from the Oklahoma Tax Commission.

Oklahoma franchise tax due date 2021 thursday february 24. The due date will be the next business day if may 15th 2022 falls on a weekend or holiday ie may 16th 2022. Tax Rate retail or wholesale 0375.

Your Oklahoma return is due 30 days after the due date of your federal return. 2021 Form 512 Oklahoma. See page 16 for methods of contacting the Oklahoma Tax Commission OTC.

Depending on the volume of sales taxes you collect and the status of your sales tax account with Oklahoma you may be required to file sales tax returns on a monthly semi-monthly quarterly. No Tax Due Threshold. Any taxpayer with a payment due by March 15 2021 andor April 15 2021 for 2020 Oklahoma income taxes andor any estimated 2021 income tax payment due by March.

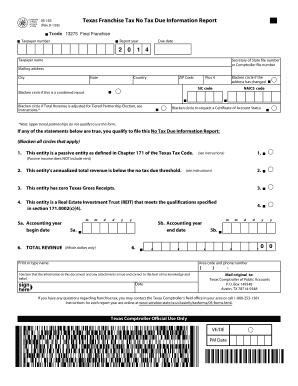

Fillable Online Window State Tx Texas Franchise Tax Final No Tax Due Information Report Window State Tx Fax Email Print Pdffiller

Salt Roadmap State And Local Tax Guide Resources Aicpa

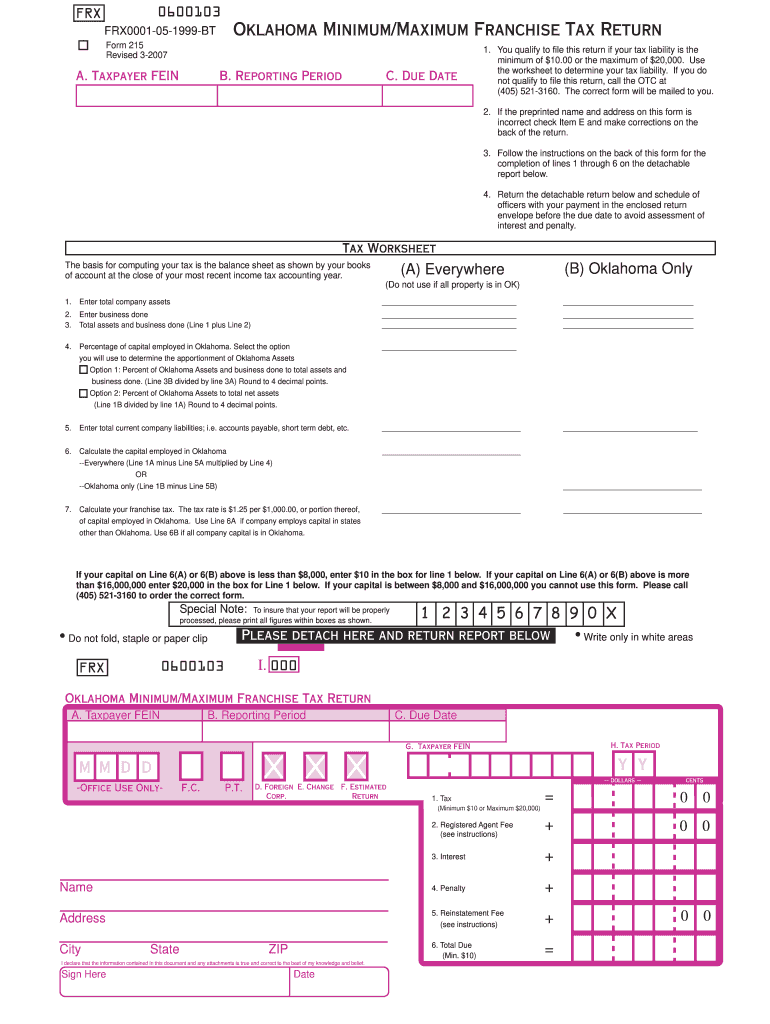

Ok Otc 215 2007 2022 Fill Out Tax Template Online Us Legal Forms

What Is Privilege Tax Types Rates Due Dates More

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Incorporate In Oklahoma Do Business The Right Way

How Failing To File Franchise Tax Returns Causes Personal Liability Texas Tax Talk

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

How To Form An Llc Advantages Disadvantages Wolters Kluwer

Corporate Income Taxes Urban Institute

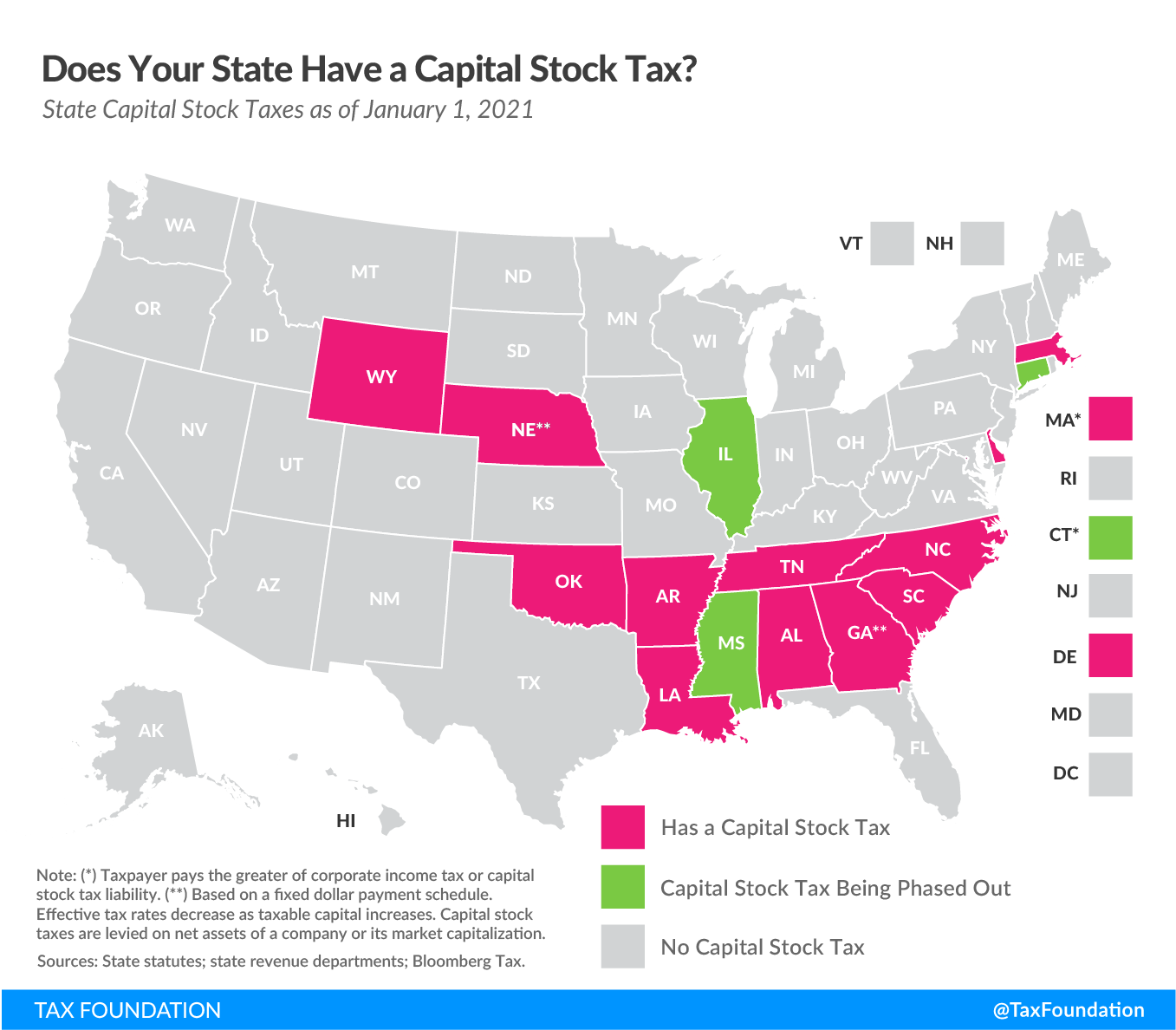

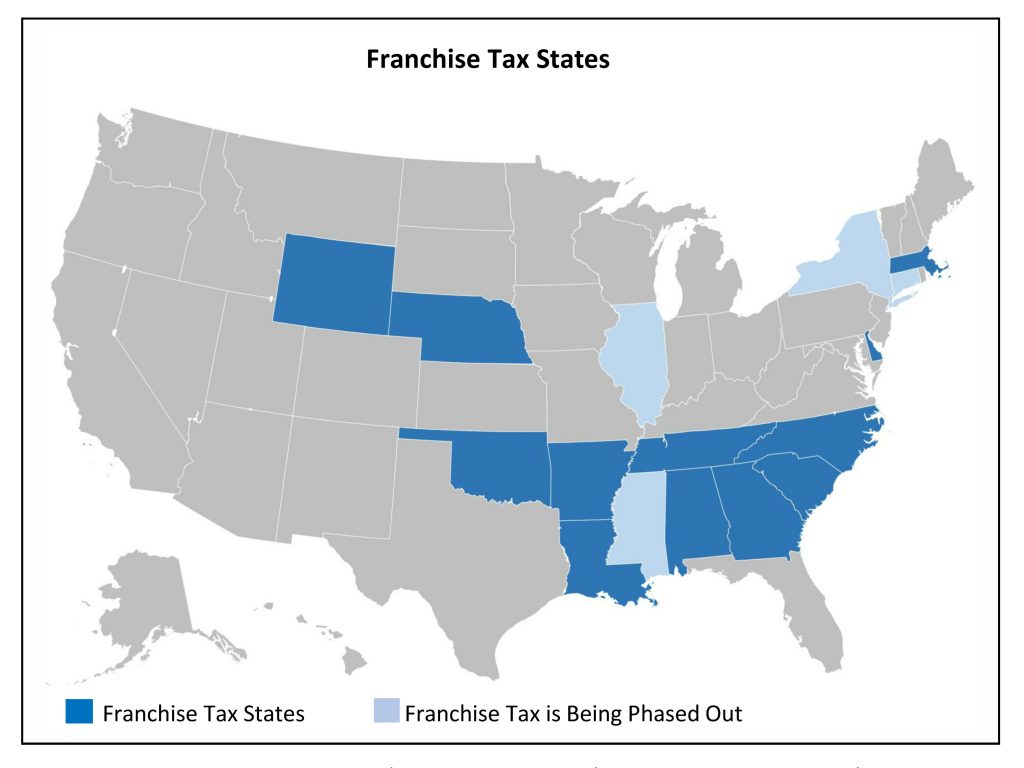

Taxpayers Federation Of Illinois Illinois Franchise Tax Still A Bad Idea

Oklahoma Tax Commission Oktaxcommission Twitter

Date To File And Pay 2019 Oklahoma Income Tax Return Extended To July Kokh

Incorporate In Oklahoma Do Business The Right Way

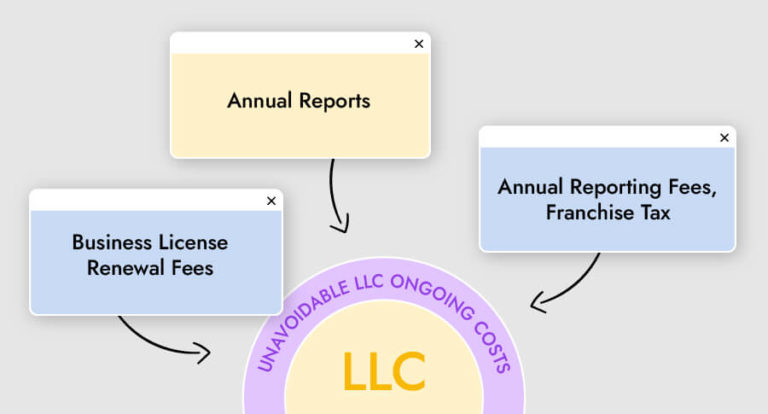

How Much Does It Cost To Start An Llc Tailor Brands

Oklahoma Tax Commission Oktaxcommission Twitter